How To Save $10,000 a Year To Get Anything For Your Loved Ones

Are you tired of running into an endless array of expenses after expenses and constantly struggling on how to save $10,000 a year?

Maybe two jobs are not enough to pay the bills. Maybe an unexpected emergency situation put you into debt and can’t find a way to come up with the money.

Whether you’re a baby boomer with little retirement savings or a millennial who only earns $40,000/year.

In this post, we talk about:

Best Money-Saving Tips That You Should Know...

What could you do with an extra $10,000 per year? Finally, buy your first car? Pay all your debt for good? Or maybe bring your family on a grand vacation?

Whatever is your reasons, I am here to tell you that you can save $10,000 a year even if your annual salary is less than $40,000 per year.

How do I know that? Because when I was working as an ex-pat I was NOT even making $40K annually. And with my intense desire to get out of debt and to end uncertainties, very quickly I was able to save $10,000 a year.

How to Save $10,000 a Year From Salary

1. Make a Plan

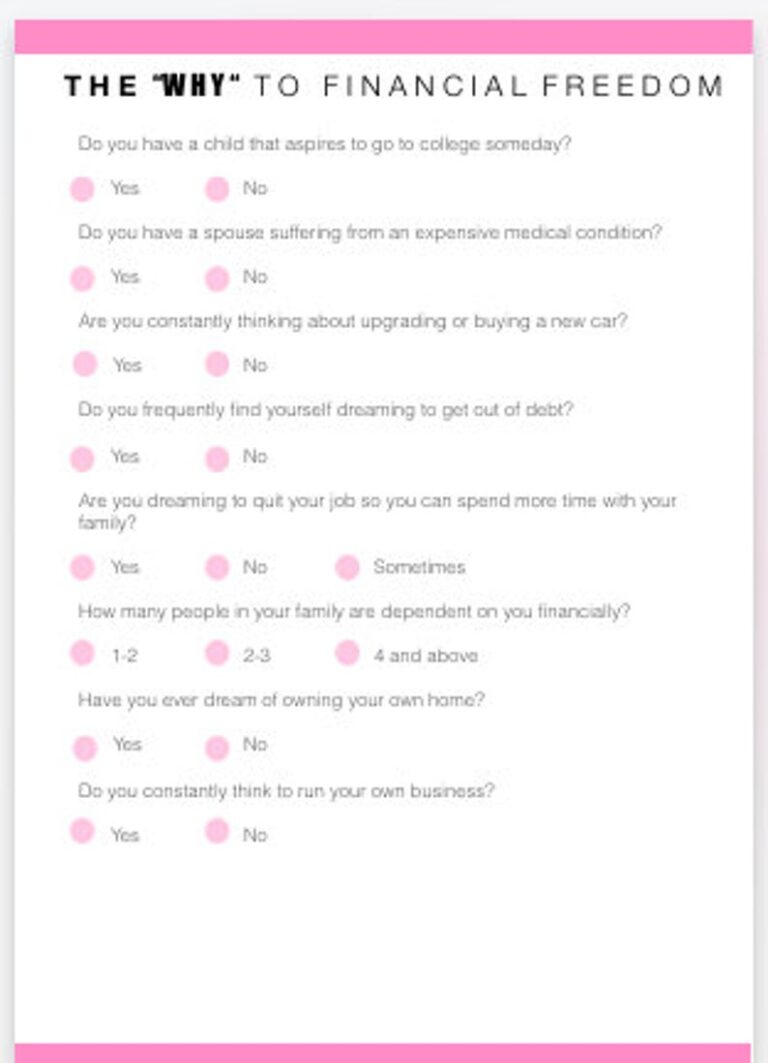

There are all sorts of reasons to save $10,000 per year. But truthfully, whether you’re building your retirement savings or just saving to pay cash for a specific purchase, the process is the same.

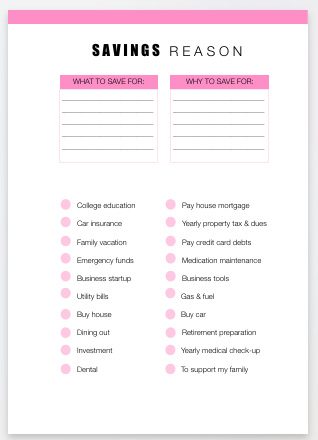

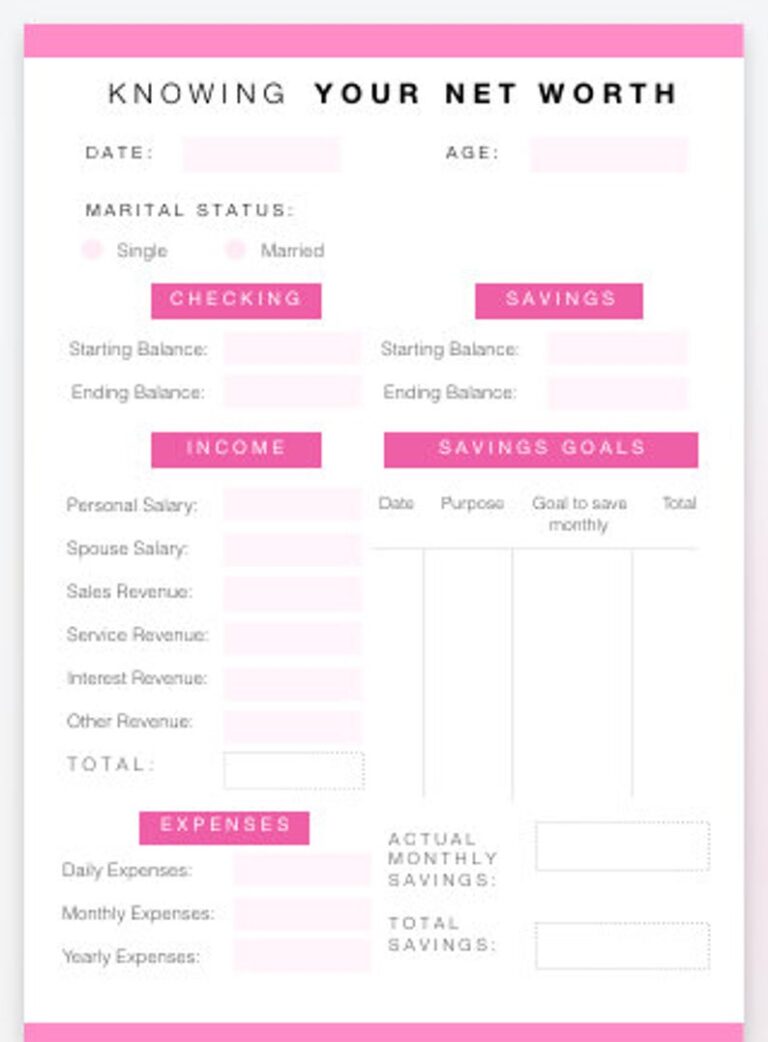

You need to make a plan why you want to save this $10K per year. Write down your reasons for what to save for and tick your top 3 priorities on the worksheet below.

2. Look at What is Going Out (your expenses)

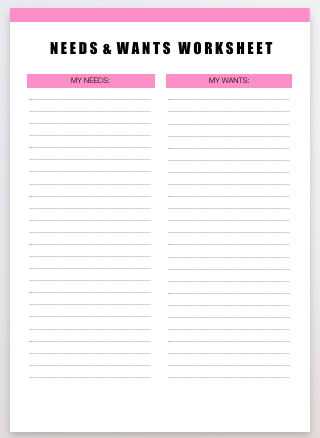

Look at your needs. Your needs are the essentials you need to survive which typically include housing expenses, monthly bills, food, transportation, and health care.

Next, identify your wants. Wants, which include another spending that is NOT really essential for your survival. Like for example, gym membership, a cup of Starbucks coffee, going for a trip, and spending on non-essentials can fall into your “wants” category spending.

Once you already categorize your needs and wants, get a rough estimate of your expenses each month.

3. Look at What is Going In (your income)

Now, you’ll want to know your income after taxes are deducted. Net income is your take-home pay after taxes and other payroll deductions. So your net income is what you normally use to pay your needs and wants.

Are you paid weekly? Every 1st and 15th of each month? Or monthly?

So, how much is your net income per month?

4. Budget Allocation

Once you have those numbers, you can start looking at the best possible ways on how you can budget your money. If your earning is less than $40K/year, get started with the 40/10/50 budget setup.

This means 40% of your budget will be allocated to your needs, 10% to your wants, and putting 50% towards your savings. Remember that you can adjust this 40/10/50 budget allocation that works better for you depending on your needs and NOT with what you want.

5. Set Smart Goals

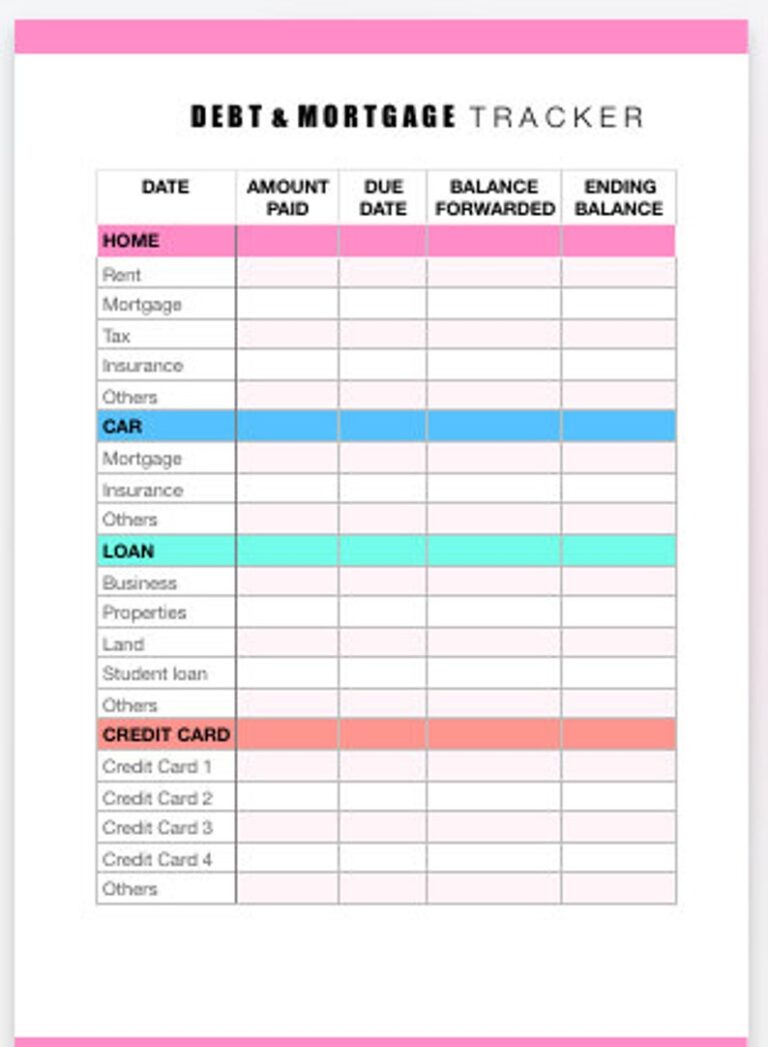

Now, what if you are holding a credit card debt or any loan? How can you set a smart goal to save? Pay off debts first or save?

If you have debts all of these numbers must also consider under your needs. So it is crucial to set SMART goals to pay off the most expensive debt first.

I used to borrow my lifestyle from credit card debt and I personally set my goal that is SMART before I even start to save money. Because if you don’t prioritize paying your credit card bills, expect to pay late fees, higher interest, and this can even create future financial struggles.

This is why SMART goal setting is crucial if you want to save $10,000 a year.

6. It’s time to start!

Once your debt’s under control or paid off to a point you’re comfortable with, then it’s time to start saving. Here’s the thing…It doesn’t matter how much money you make, or whether you live in New York or in the Philippines, this thing works!

Because when I spilled this secret (actually, not a secret at all) to my sister who was also drowning in credit cards debts… She finally also able to escape her restless nights dilemma and able to save, put aside $1,000 to invest and grow this to $3K, and even travel to Australia and pay this trip in cash.

What we have in common? Both of us were able to set a SMART goal with a specific time-bound to get out of debt in two years.

Me

My debt: $17,000

Annual Income: < $40K

SMART goal: Pay my debt in 2 yrs

My sister

Her debt: $3,000

Annual Income: < $20K

SMART goal: Pay her debt in 2 yrs

Once you start creating a habit of budget allocation, then this is how it can help you to stay on top of your bills and save $10,000 a year.

How Much Should You Save Per Month

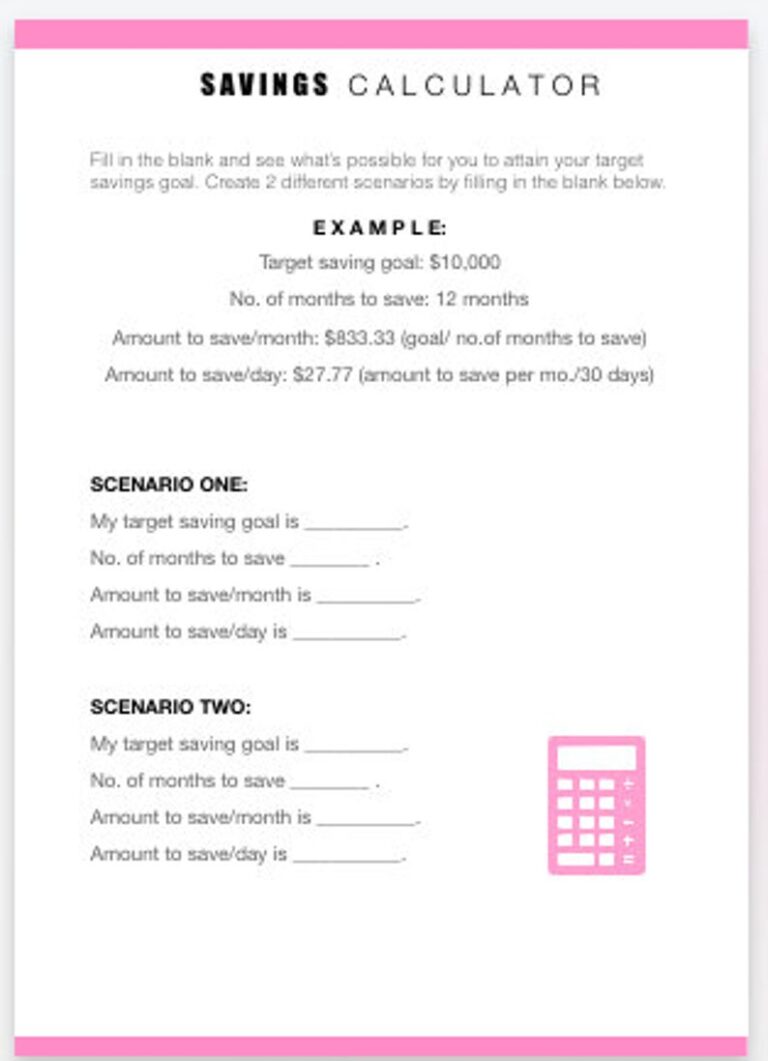

Okay, if your goal is to save $10,000 a year then let’s do the math.

Target saving goal: $10,000

No. of months to save: 12 months

Amount to save/month: $833.33 (goal/no. of months to save)

Amount to save/day: $27.77 (amount to save per mo./30 days)

So, simply cutting out all your spending that falls to your “wants” category will help you save this amount per day.

This means no latte coffees, food spa, home decor, dining out, food delivery, entertainment, monthly subscriptions, new clothing, and shoes.

How to Create a Budget Per Month

No wonder why most financial gurus like Dave Ramsey, Robert Kiyosaki, and Suze Orman suggest making a monthly budget. The good news is you don’t have to be a financial specialist to do that.

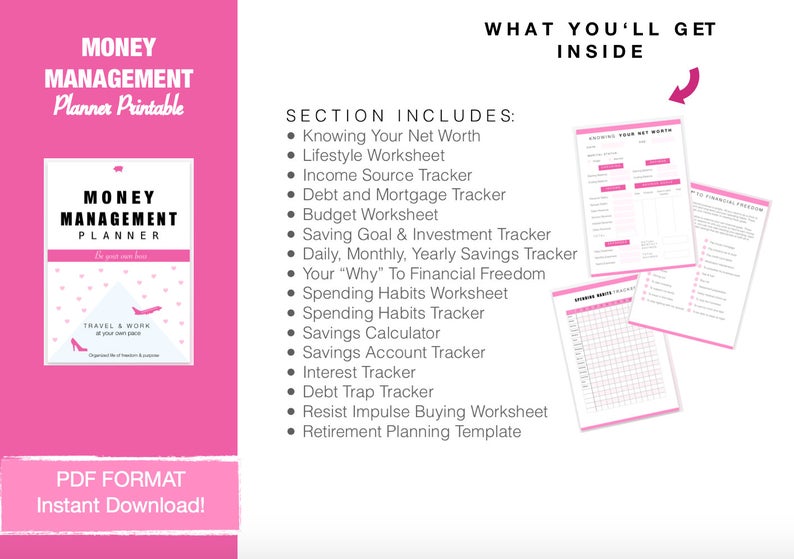

Now that I’m a little older and experience, I want to help you to bring order to your financial goals using my Money Management Planner Printable, not only to create your budget per month but to start managing your cash flow and track your income and monthly expenses because, in the world of commercialism, it’s easy to spend a few bucks here and there and quickly find out that you’re spending more than you can afford.

Money Management Planner, Personal Finance Management, Savings Planner, Money Templates, Mortgage & Debt Tracker & Retirement Planning, Savings Worksheet (PDF Instant Download!)

My Best Collection of Design Your Money Planner Printable

You don’t want to fall into a debt trap, don’t you? Moreover, keeping track of your finances can play an important role in the pace you improve your savings account and save money for your dream vacation, house, car, or even for your early retirement.

If you’re a100% organized person and like to plan everything with pen and paper, then my Money Management Planner Printable will be a perfect solution for you. Here is the collection of the best money management templates that you can instantly download, economical for you to start designing your money.

Final Thoughts:

Instant gratification is seen as the norm for many people and I can assure you that instant gratification from borrowed money is a BIG source of frustration, sleepless nights, anxiety, and even unhappy family.

Believe me, the ability to do some sacrifices now for a better reward later is an essential life skill and BEST gift that you can give yourself now and your loved ones.

To recap, here’s what we have covered in this post:

Enjoy this article? Pin It!

How am I able to Turn My Travel Dream To Reality?

About Jeng Cua

After borrowing her lifestyle living paycheck to paycheck, this work from anywhere mom wouldn’t let anything stop her from chasing her dreams. Now, Jeng has achieved more than she ever imagined. Her mission is pretty simple – to help you love your life and family using her four distinct life systems.