How to Make a Budget: The 40/10/50 Rule

Do you feel frustrated when you get to the end of the month and you have no money? Does the word “budget” give you an awful feeling in the pit of your stomach?

I know it’s very hard to live on borrowed money because I’ve been there.

So in this post, we’ll talk about:

How to Create a Budget for a Beginner

If you’ve read my previous post on how to save $10K a year to get anything for your loved ones, you know I love talking about money matters. And today’s post is all about how to budget your money that I think might be a great one for you to use and improve your life for the better.

Are you single or married? If you are married, do you share money with your spouse or partner?

Create a Money Blueprint

Eventually, you want to end up with a blueprint that specifically breaks down your income and expenses, so you will know how to budget your money and how much you can save each month.

Start first by knowing how much money you are making and if you are married the total amount of money you and your spouse make.

Once you’ve figured out your income and expenses, then creating a budget each month will help you sleep better and decrease your stress levels on how to make ends meet each month.

What is the 40/10/50 budget rule?

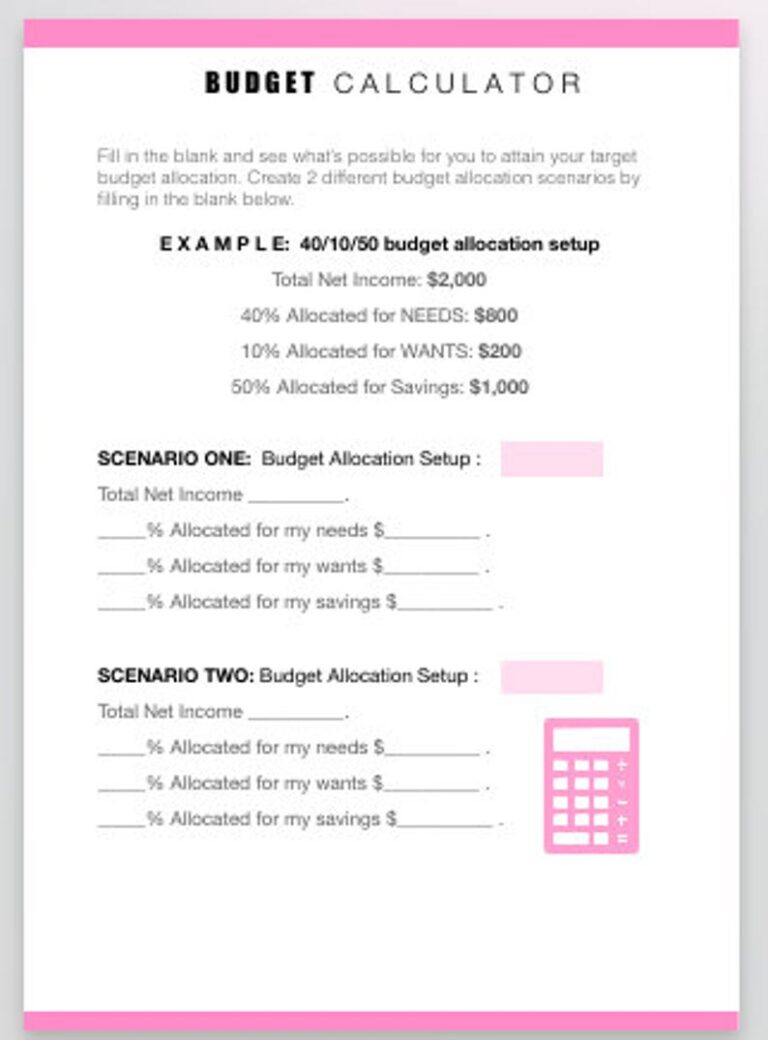

Actually, this is how you allocate your money into three different categories – needs, wants, and savings. This is to determine what amount of money should be put into every three categories.

This means 40% of your budget will be allocated to your needs, 10% to your wants, and putting 50% towards your savings.

40% OF YOUR BUDGET SHOULD GO ON NEEDS

Depending on your situation whether you are single or married or living in a 3 bedroom house or studio type apartment, the “NEED” category are all things that are essential for you and your family to survive.

The main things included in this category are:

- Housing costs – rent/mortgage

- Utilities – gas and/or electric

- Food – a basic necessity

- Healthcare – critical illness/emergency funds

All of these things are essential to be part of your monthly budget for the well-being of you and your family.

10% OF YOUR BUDGET SHOULD GO ON WANTS

These are the things that are really NOT essential for you and your family to survive. This means you can afford to live without it. These could include:

- Vacation (believe me it’s not fun to take a vacation with borrowed money. This thing can wait! – This is our # 4 distinct way to love yourself and family).

- Spa

- Gym Membership

- Monthly Subscription

- Entertainment

- Dining Out

- Starbucks Coffee

These things depend on your lifestyle that is extra. Meaning you can opt to eliminate these “WANTS” from your monthly expenditures.

50% OF YOUR BUDGET SHOULD GO TO SAVINGS

If you’re a dual-income couple, the easiest way to save half is by living on one person’s income while saving the other. Luckily, when my husband and I, used to work together in the same company as an ex-pat, this is what we have done in order for us to secure our future.

This will be depending on your situation. If your budget is tight and 50% is not feasible, then you can start with 20% of your income should go towards savings. And you can simply allocate the remaining 30% to others like paying off debts/mortgage before putting the big chunks of your money into savings.

Now, does this work?

Yes, it works for me and will definitely work for anyone who’s serious to know the ins and outs of their money.

And the beauty of this, it does not require you to budget down to the penny or stick with the 40/10/50 rule because you can adjust this budget allocation that suits your income.

The most important is to prioritize your needs when you are creating a budget and how willing are you to make some changes in your current lifestyle?

I think the 40/10/50 might be a great starting point if you’re just thinking about budgeting. And, over time, you could just change what budget works better for you.

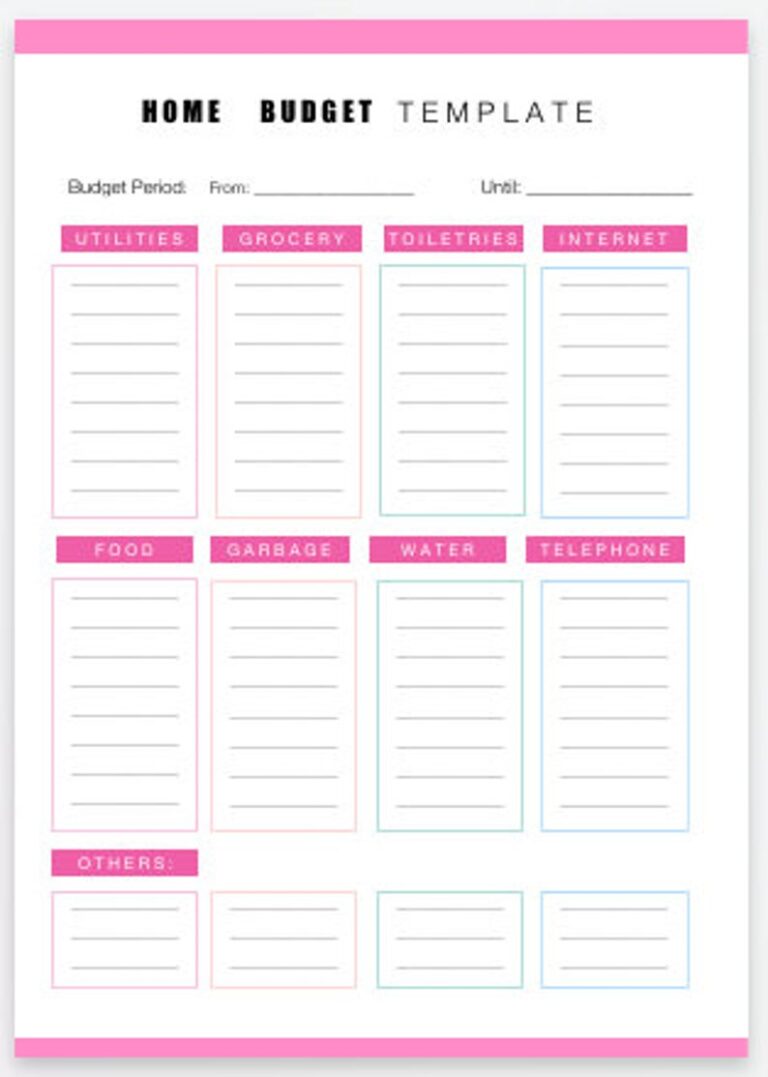

Best Budget Template That Will Help Control Your Money

Actually, there’s a lot of budget templates, tools, and budget apps that you can Google and use.

Whatever you may need money for, it’s important that you track your spending habits and stick with your set budget. It is a great way to keep your money in order and be on top of every dollar you earn.

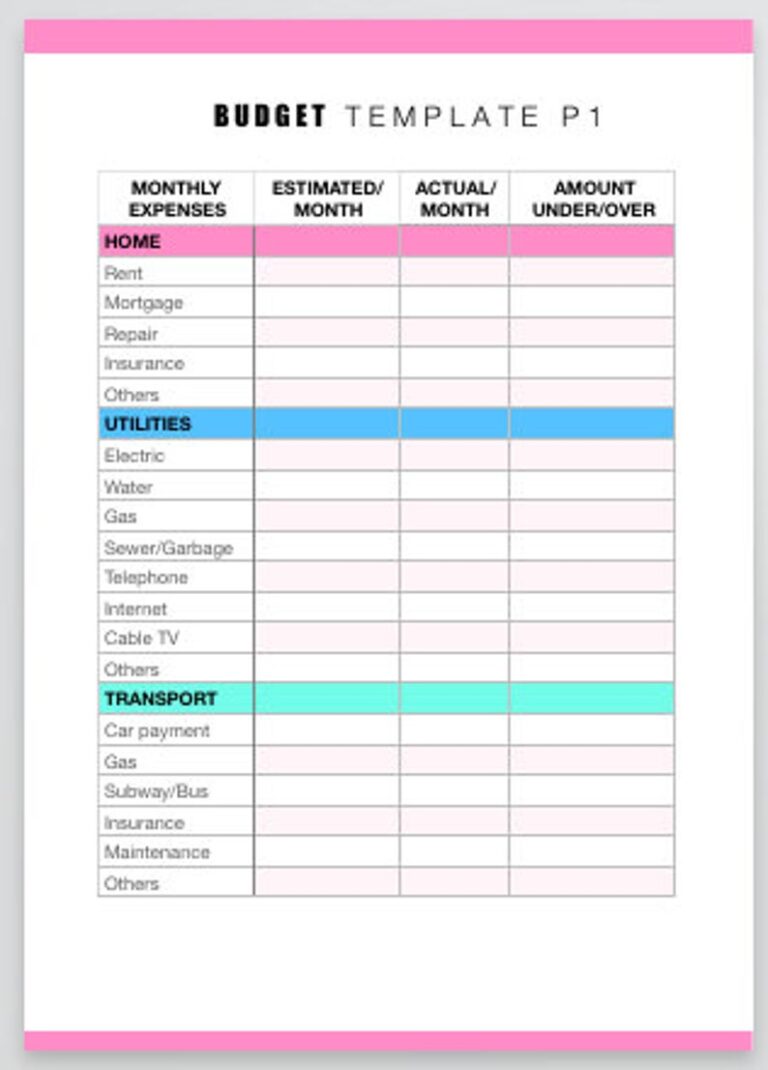

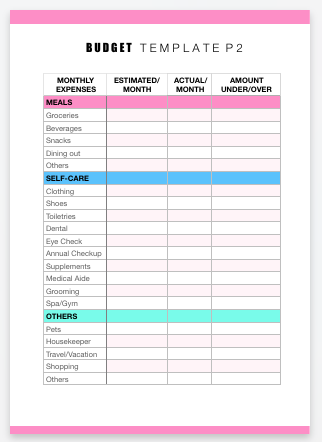

Now, by using the Budget Template that I personally designed, you will be able to notice patterns in your spending habits, make adjustments, and gain control over your finances to reach your financial goals and live the version of the life you want.

This printable budget template helps you keep track of your money because living beyond your means is a frightening behavior to put yourself and your loved one into a never-ending financial mess that can even lead to feeling loss of control, anxiety, and other mental distress.

Click here to get my Budget Template that will help you to start being in control of where your money goes. From tracking every day your spending, create your own money budget allocation, that will help you achieve all your dreams, and design your future!

Final Thoughts

Make it happen for yourself because no one else is going to create the budget for you. Believe me, it’s never too late to chase your dreams!

To recap, here’s what we have covered in this post:

Enjoy this article? Pin It! And share this post with your friends

MORE LIFE SKILLS RESOURCES:

How to set SMART life goals?

Check my 3-part blog series about the goal-setting process to crush goals.

How to manage your personal finances?

Head on to money matters to help you manage your money wisely.

How to work at your own pace?

Check my be your own boss journey doing what you love and earn without any fancy office.

How to turn your travel dream into reality?

Check my 7 chapters jam-packed ebook to help you plan, pack, and save money faster for your next trips!

About Jeng Cua

After borrowing her lifestyle living paycheck to paycheck, this work from anywhere mom wouldn’t let anything stop her from chasing her dreams. Now, Jeng has achieved more than she ever imagined. Her mission is pretty simple – to help you love your life and family using her four distinct life systems.